Silver is a precious white metal which symbol is Ag. Its name comes from the Latin Argentum. Its melting temperature is 961° and its density is 10 490 kilogramme/m3.

Industrial use of silver is often associated with the declining use of film, then it represents only 1 / 10 of its use. Silver is used for its conductivity (electronic) and properties bactericidal (nanotechnology of Health). Since the advent of digital photography, industrial demand has largely offset the decline in demand for photographic film. Physical properties of silver: ductility, conductivity, malleability, make its industrial use is increasing every year. Industrial demand for silver represents half of the silver in the world. Silver is used for its qualities in the electronic conductivity of quality: mobile phones, printed circuit, solar cell. As conductor of electricity, It is better than copper or gold. Diamond is the best driver, but it is much more expensive and less convenient as you will agree. Silver is also used for its bactericidal properties (clothing, bandages, refrigerators, water purifiers, dental amalgam ,...). Silver is also used as a catalyst, for soldering or welding in the manufacture of battery, mirror. The jewel is the second source of consumption of silver with a small quarter of the requests, and one small quarter of the demand comes from photography, coins, and silver medals.

On the supply side, 8 / 10 are provided by mining, 2 / 10 by recycling (sales of central bank silver declines). This is the recycling of silver that makes up the difference between demand and world production of silver. However, it is increasingly difficult to launder silver, given the decline in photographic film and the rise of industrial use. It is indeed used in many products in small quantities.

I. Production of silver : a by-product.

Only a small third of silver production comes from the production of silver mines, the rest comes from a small third of mine production of zinc and lead, a quarter of the copper mines and one-eighth of gold mines (the natural alloy of gold and silver is called electrum). That silver is expensive or not, it has little importance for ¾ producers silver in the world because they are producers of zinc, lead, copper and gold before being producers of silver. I am not saying that this does not concern them, but the price of zinc, lead, copper and gold that matter most to them. These metals are their primary source of income, silver is only one income. The price of silver is like the “icing on the cake”. For this reason the production of silver is unique, it depends on the fundamentals of zinc, copper, lead and gold. As production of platinum is separated from the palladium, the money is inseparable from the production of gold and industrial metals such as copper, zinc and lead. Thus the first five silver producing countries are all part of the top 5 producers of copper, zinc, lead and gold.

According to the USGS silver production in the world in 2008 is estimated at 20 900 tonnes of silver or 671 million ounces of silver, a new record for silver production. In 2007, production was 20 800 tonnes of silver, or 668 million ounces of silver. Silver production has benefited from record zinc prices in 2006 / 2007, of copper from 2006 to 2008, lead in August 2007, gold and silver in 2008. It is therefore not surprising that 2007 and 2008 to be record years for the production of silver. However, the end of 2008 and early 2009 have seen the price of zinc, copper, and lead collapse below their current production. At that time the bank funding disappears and capitalization mine down, and this will have consequences on the production of silver in 2009 despite the high price of gold and silver.

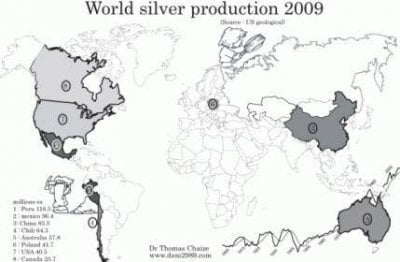

II. Major producers of silver in the world.

1. Peru produced 118.5 million ounces of silver in 2008, 17.6% of world production of silver. The four largest mines of Peru produce 47.2% of the silver of the country, 55 million ounces of silver produced in 2008. The production of silver has almost doubled since 1998 from 65 million ounces of silver to 118 million ounces of silver (3 685 tonnes of silver).

These four mines primarily produce zinc, gold, copper and even molybdenum. The production of silver is an associate production. Peru is the largest producer in the world of silver, the second largest producer of copper, the third largest producer of zinc, lead the fourth and fifth gold. His first producer of silver is the result of the high level of the four other productions.

2. Mexico is the second largest producer of silver. In 2008, Mexico produced 96.4 million ounces of silver (3 000 tonnes of silver). Mexico is to silver production that South Africa was to gold production. Mexico has lost its position as leading producer of silver in favor of Peru in 2002. Mexico is also the 6th producer of zinc and lead producer 5th.

3. Silver production in China is 83.5 million ounces of silver in 2008 (2600 tonnes of silver). China is the 3rd producer of silver in the world. The main reason is probably the most important Chinese production of zinc. Indeed, China is by far the largest producer of zinc in the world. China is also the 1st largest producer of lead and gold.

4. Chile has produced 64.3 million ounces of silver (2 000 tonnes of silver) last year which gives him the rank of fourth largest producer of silver. This large production of silver is closer to its position as the world's largest producer of copper.

5. Australia is the fifth largest producer of silver in the world with a production of 57.8 million ounces of silver (1 800 tonnes of silver). Australia is also the 2nd largest producer of zinc and lead, 4th largest gold and 5th place for copper. Australian production of silver is only a by-product of these metals.

6. The majority of the production of silver from Poland which is the 6th largest producer of silver with 41.7 million ounces of silver (1300 tonnes of silver) comes to 90% of one copper mine.

The 7th and the 8th largest producer of silver are the USA with 40.5 million ounces of silver (1 260 tonnes of silver) and Canada with 25.7 million ounces of silver (800 tons of silver). They both were the world's leading producers of silver in the early 1970s, are both below their level of production time.

The production of silver depends on ¾ of the mine production of copper, zinc, lead and gold. The production of silver depends on the prices of these metals that the price of silver itself!

The production of silver increased while production of copper, zinc, lead and gold increased. The fact that the first five silver producing countries are also the leading producer of copper, zinc, lead and gold is not a coincidence but geology. I have already broached the subject of production of gold and zinc, there are two unknown copper and lead. I write about these two metals in the coming months to give you all the pieces of the production silver in the world.