No estamos solos: Francia está con nosotros

De Zerohedge:

If CDS Traders Are Right, France Is Next Up For A Sovereign Shakedown (As Are Spain And Portugal); Greece Long Forgotten | zero hedge

Básicamente, dice que ya no hay dinero que hacer con CDS de Grecia, y el siguiente asalto va a ser sobre España y Portugal, como estaba previsto, pero que Francia va a caer antes, gracias a sus préstamos a los bancos del Sur de Europa (España incluída).

De Zerohedge:

If CDS Traders Are Right, France Is Next Up For A Sovereign Shakedown (As Are Spain And Portugal); Greece Long Forgotten

Tyler Durden's picture

Submitted by Tyler Durden on 04/17/2010 22:43 -0500

* Dubai

* France

* Germany

* Greece

* Japan

* Net Notional

* Portugal

* Primary Market

CDS traders were prescient in snapping up Greek and Dubai CDS long before anyone else realized the risk these countries are in (well, more like Goldman selling CDS to some very close clients, wink wink). In exchange for figuring out what it took cash bond holders months to understand, these 'speculators' made a lot of money and in the process got branded as quasi-sovereign terrorists. Well, Greece can sleep well: according to the latest DTCC CDS data (for the week ended April 9), CDS specs have completely deserted Greece, which saw the single biggest amount of Net Notional CDS decrease, to just over $8 billion, a reduction of $367 million in the prior week (which means all the widening in Greek spreads is now, and has been, just cash bond sales, precisely what Zero Hedge has claimed all along). CDS traders are now focusing their attention on the one country which has so far slipped under everyone's radar, yet which we disclosed is more on the hook in terms of Southern European exposure than even Germany: France, with $781 billion in total claims. Should Greece topple the PIIGS dominoes, France will implode. And this is precisely what CDS traders are betting on now, taking advantage of absurdly tight France CDS levels. Also, just in case they are wrong on France, Spain and Portugal, not surprisingly, round out the top three names in which Net Notional saw the largest increase. Also not surprisingly, Japan rounds out the top 5 deriskers.

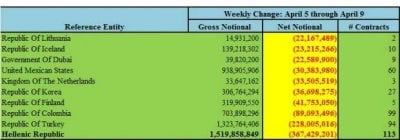

Top 10 deriskers:

Greece, and Dubai, are both among the top 10 reriskers, indicating that any profits to be made from widening in Greece and Dubai have already been taken. At this point residual hedging and unwinds is all that remains. We are confident that very little new Greece CDS exposure will be put on as nobody wants to hedge primary market positions as alas the GGB issuance market is now done.

Source: DTCC

If CDS Traders Are Right, France Is Next Up For A Sovereign Shakedown (As Are Spain And Portugal); Greece Long Forgotten | zero hedge

Básicamente, dice que ya no hay dinero que hacer con CDS de Grecia, y el siguiente asalto va a ser sobre España y Portugal, como estaba previsto, pero que Francia va a caer antes, gracias a sus préstamos a los bancos del Sur de Europa (España incluída).