El Ariki Mau

Make Risia LOL again

- Desde

- 4 Oct 2014

- Mensajes

- 52.588

- Reputación

- 110.590

Solo está disponible en anglis el engendro, la idea es buscarle las 7 falacias al panfleto... @luisito2 te invoco.

En tu cara sin inmutarse propaganda marxista

Wealth inequality is escalating at an alarming rate not only within the U.S. but also in countries as diverse as Russia, India and Brazil. According to investment bank Credit Suisse, the fraction of global household wealth held by the richest 1 percent of the world's population increased from 42.5 to 47.2 percent between the financial crisis of 2008 and 2018. To put it another way, as of 2010, 388 individuals possessed as much household wealth as the lower half of the world's population combined—about 3.5 billion people; today Oxfam estimates that number as 26. Statistics from almost all nations that measure wealth in their household surveys indicate that it is becoming increasingly concentrated.

Although the origins of inequality are hotly debated, an approach developed by physicists and mathematicians, including my group at Tufts University, suggests they have long been hiding in plain sight—in a well-known quirk of arithmetic. This method uses models of wealth distribution collectively known as agent-based, which begin with an individual tras*action between two “agents” or actors, each trying to optimize his or her own financial outcome. In the modern world, nothing could seem more fair or natural than two people deciding to exchange goods, agreeing on a price and shaking hands. Indeed, the seeming stability of an economic system arising from this balance of supply and demand among individual actors is regarded as a pinnacle of Enlightenment thinking—to the extent that many people have come to conflate the free market with the notion of freedom itself. Our deceptively simple mathematical models, which are based on voluntary tras*actions, suggest, however, that it is time for a serious reexamination of this idea.

In particular, the affine wealth model (called thus because of its mathematical properties) can describe wealth distribution among households in diverse developed countries with exquisite precision while revealing a subtle asymmetry that tends to concentrate wealth. We believe that this purely analytical approach, which resembles an x-ray in that it is used not so much to represent the messiness of the real world as to strip it away and reveal the underlying skeleton, provides deep insight into the forces acting to increase poverty and inequality today.

Oligarchy

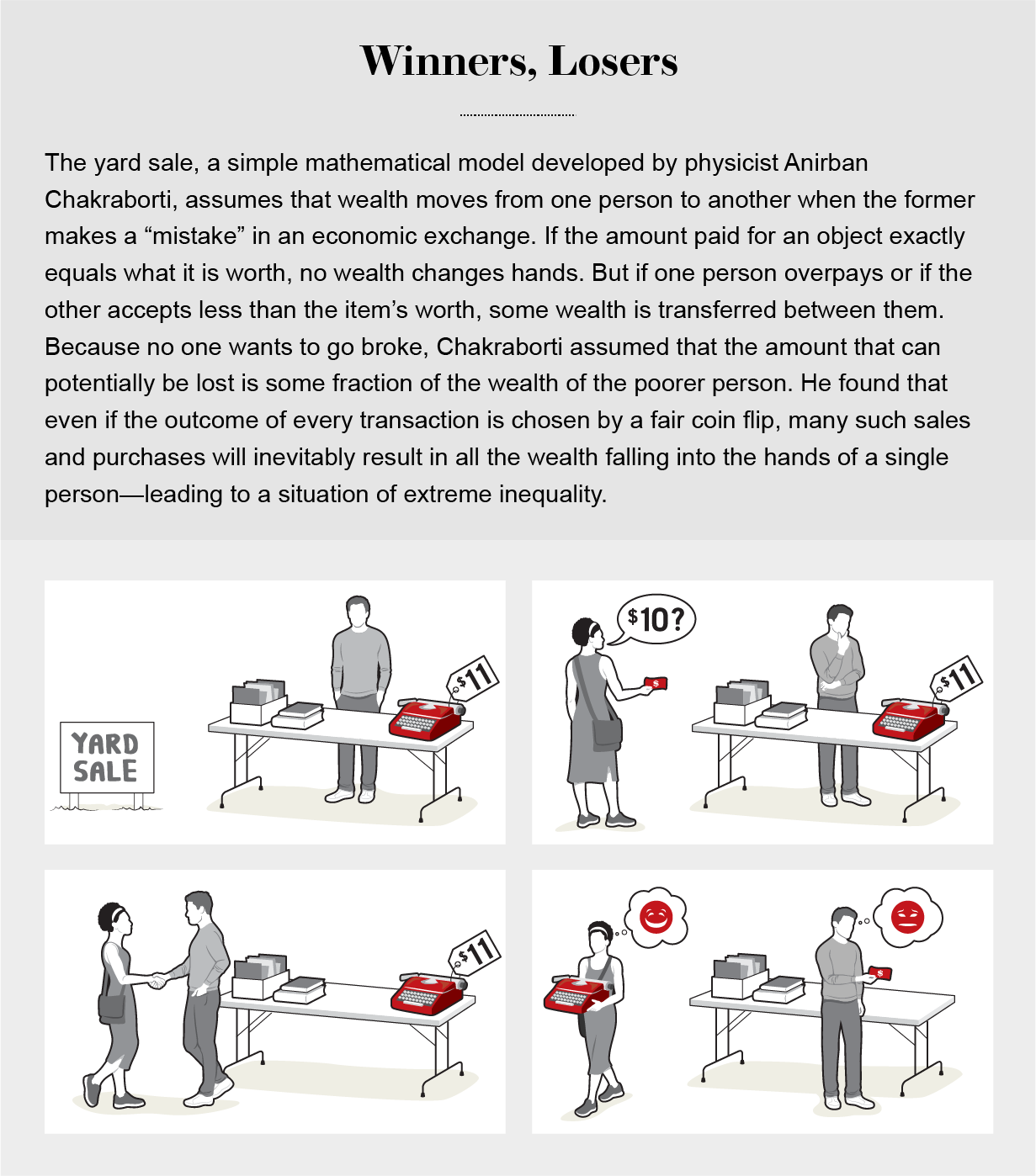

In 1986 social scientist John Angle first described the movement and distribution of wealth as arising from pairwise tras*actions among a collection of “economic agents,” which could be individuals, households, companies, funds or other entities. By the turn of the century physicists Slava Ispolatov, Pavel L. Krapivsky and Sidney Redner, then all working together at Boston University, as well as Adrian Drgulescu, now at Constellation Energy Group, and Victor Yakovenko of the University of Maryland, had demonstrated that these agent-based models could be analyzed with the tools of statistical physics, leading to rapid advances in our understanding of their behavior. As it turns out, many such models find wealth moving inexorably from one agent to another—even if they are based on fair exchanges between equal actors. In 2002 Anirban Chakraborti, then at the Saha Institute of Nuclear Physics in Kolkata, India, introduced what came to be known as the yard sale model, called thus because it has certain antiestéticatures of real one-on-one economic tras*actions. He also used numerical simulations to demonstrate that it inexorably concentrated wealth, resulting in oligarchy.

Credit: Brown Bird Design

To understand how this happens, suppose you are in a casino and are invited to play a game. You must place some ante—say, $100—on a table, and a fair coin will be flipped. If the coin comes up heads, the house will pay you 20 percent of what you have on the table, resulting in $120 on the table. If the coin comes up tails, the house will take 17 percent of what you have on the table, resulting in $83 left on the table. You can keep your money on the table for as many flips of the coin as you would like (without ever adding to or subtracting from it). Each time you play, you will win 20 percent of what is on the table if the coin comes up heads, and you will lose 17 percent of it if the coin comes up tails. Should you agree to play this game?

You might construct two arguments, both rather persuasive, to help you decide what to do. You may think, “I have a probability of ½ of gaining $20 and a probability of ½ of losing $17. My expected gain is therefore:

½ x ($20) + ½ x (-$17) = $1.50

which is positive. In other words, my odds of winning and losing are even, but my gain if I win will be greater than my loss if I lose.” From this perspective it seems advantageous to play this game.

Or, like a chess player, you might think further: “What if I stay for 10 flips of the coin? A likely outcome is that five of them will come up heads and that the other five will come up tails. Each time heads comes up, my ante is multiplied by 1.2. Each time tails comes up, my ante is multiplied by 0.83. After five wins and five losses in any order, the amount of money remaining on the table will be:

1.2 x 1.2 x 1.2 x 1.2 x 1.2 x 0.83 x 0.83 x 0.83 x 0.83 x 0.83 x $100 = $98.02

so I will have lost about $2 of my original $100 ante.” With a bit more work you can confirm that it would take about 93 wins to compensate for 91 losses. From this perspective it seems disadvantageous to play this game.

The contradiction between the two arguments presented here may seem surprising at first, but it is well known in probability and finance. Its connection with wealth inequality is less familiar, however. To extend the casino metaphor to the movement of wealth in an (exceedingly simplified) economy, let us imagine a system of 1,000 individuals who engage in pairwise exchanges with one another. Let each begin with some initial wealth, which could be exactly equal. Choose two agents at random and have them tras*act, then do the same with another two, and so on. In other words, this model assumes sequential tras*actions between randomly chosen pairs of agents. Our plan is to conduct millions or billions of such tras*actions in our population of 1,000 and see how the wealth ultimately gets distributed.

Credit: Hanna Barczyk

What should a single tras*action between a pair of agents look like? People have a natural aversion to going broke, so we assume that the amount at stake, which we call Δω (Δω is pronounced “delta w”), is a mere fraction of the wealth of the poorer person, Shauna. That way, even if Shauna loses in a tras*action with Eric, the richer person, the amount she loses is always less than her own total wealth. This is not an unreasonable assumption and in fact captures a self-imposed limitation that most people instinctively observe in their economic life. To begin with—just because these numbers are familiar to us—let us suppose Δω is 20 percent of Shauna's wealth, ω, if she wins and –17 percent of ω if she loses. (Our actual model assumes that the win and loss percentages are equal, but the general outcome still holds. Moreover, increasing or decreasing Δω will just extend the time scale so that more tras*actions will be required before we can see the ultimate result, which will remain unaltered.)

If our goal is to model a fair and stable market economy, we ought to begin by assuming that nobody has an advantage of any kind, so let us decide the direction in which w is moved by the flip of a fair coin. If the coin comes up heads, Shauna gets 20 percent of her wealth from Eric; if the coin comes up tails, she must give 17 percent of it to Eric. Now randomly choose another pair of agents from the total of 1,000 and do it again. In fact, go ahead and do this a million times or a billion times. What happens?

If you simulate this economy, a variant of the yard sale model, you will get a remarkable result: after a large number of tras*actions, one agent ends up as an “oligarch” holding practically all the wealth of the economy, and the other 999 end up with virtually nothing. It does not matter how much wealth people started with. It does not matter that all the coin flips were absolutely fair. It does not matter that the poorer agent's expected outcome was positive in each tras*action, whereas that of the richer agent was negative. Any single agent in this economy could have become the oligarch—in fact, all had equal odds if they began with equal wealth. In that sense, there was equality of opportunity. But only one of them did become the oligarch, and all the others saw their average wealth decrease toward zero as they conducted more and more tras*actions. To add insult to injury, the lower someone's wealth ranking, the faster the decrease.

This outcome is especially surprising because it holds even if all the agents started off with identical wealth and were treated symmetrically. Physicists describe phenomena of this kind as “symmetry breaking” [see The Physics of Inequality below]. The very first coin flip tras*fers money from one agent to another, setting up an imbalance between the two. And once we have some variance in wealth, however minute, succeeding tras*actions will systematically move a “trickle” of wealth upward from poorer agents to richer ones, amplifying inequality until the system reaches a state of oligarchy.

If the economy is unequal to begin with, the poorest agent's wealth will probably decrease the fastest. Where does it go? It must go to wealthier agents because there are no poorer agents. Things are not much better for the second-poorest agent. In the long run, all participants in this economy except for the very richest one will see their wealth decay exponentially. In separate papers in 2015 my colleagues and I at Tufts University and Christophe Chorro of Université Panthéon-Sorbonne provided mathematical proofs of the outcome that Chakraborti's simulations had uncovered—that the yard sale model moves wealth inexorably from one side to the other.

Does this miccionan that poorer agents never win or that richer agents never lose? Certainly not. Once again, the setup resembles a casino—you win some and you lose some, but the longer you stay in the casino, the more likely you are to lose. The free market is essentially a casino that you can never leave. When the trickle of wealth described earlier, flowing from poor to rich in each tras*action, is multiplied by 7.7 billion people in the world conducting countless tras*actions every year, the trickle becomes a torrent. Inequality inevitably grows more pronounced because of the collective effects of enormous numbers of seemingly innocuous but subtly biased tras*actions.

RESTO DEL ARTICULO

https://www.scientificamerican.com/article/is-inequality-inevitable/

En tu cara sin inmutarse propaganda marxista